Market Check is a pre-trade price transparency tool that compares the price of an offering to recent trade prices on that CUSIP. Financial advisors are warned of offering prices that could be off the market. Market Check is available on the search results display but is also automatically performed at the time an order is placed.

When a broker considers the purchase of a security, Market Check presents a real-time evaluation of the security's current pricing against TRACE/MSRB recently reported trades for that security. If the price appears to be out-of-line, a warning is presented to the user that indicates further investigation may be required.

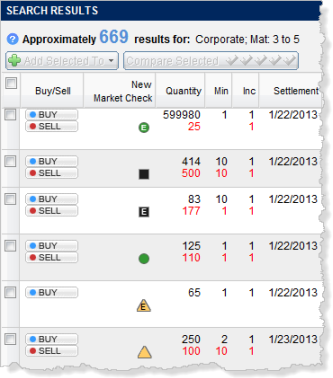

Market Check is available in the Bond Offering Detail overlay, Search Results page, and Bid Wanteds blotter. The field displays an icon that identifies pre-trade price evaluation results. View an example?

One of the following icons can appear in the column:

| Icon | Pre-trade Price Evaluation Meaning |

| Verified | |

| Verified and events have been reported within the last six months | |

| Needs further review | |

| Needs further review and events have been reported within the last six months | |

| Insufficient data | |

| Insufficient data and events have been reported within the last six months |

Hover over the icon to display the Market Check hover. View an example?

The hover may contain the following additional information:

Date, time, price, yield, quantity, and trade type for the last reported trade for verified trades

The five most recent material events in the last six months for municipal bonds

Latest disclosure filing

Click the View All link in the hover to display the Material Events tab of the Bond Offering Detail overlay for municipal bonds or the Events tab for corporate, agency, and CD securities.

Click the Go to MarketView link to display the MarketView tab of the Bond Offering Detail overlay.

![]()